Competitive pricing for industry-loss warranty (ILW) protection has fueled significant interest among an expanding base of buyers during the January 1, 2025, reinsurance renewals, according to broker Howden Re.

The ILW market has maintained strong activity levels, a trend observed throughout the challenging market cycle, as highlighted in Howden Re's latest renewals report. Buyers have been seeking attractively priced retrocessional coverage, while some primary carriers have strategically acquired industry-loss trigger protections, including derivative and securitized catastrophe bond formats, due to their competitive pricing.

According to Howden Re, transaction volumes in terms of trade size, count, and limits for ILWs have increased as more reinsurers and insurers incorporate these industry-loss index-triggered products into their broader risk management strategies. The broker estimates that the ILW market expanded by approximately 10% to $7.7 billion in transacted limits from 2023 to 2024.

The market's adaptability has enabled it to weather significant challenges, including major losses from events like Hurricane Ian, record-high pricing, volatile supply and demand dynamics, and a forecasted hyperactive 2024 hurricane season that resulted in minimal ILW losses. Despite uncertainties surrounding loss estimates for major hurricanes Helene and Milton in 2024, buyer behavior remained consistent, as most ILW triggers are set at higher industry-loss thresholds.

Some clients are reassessing their purchasing strategies, driven by the need to safeguard earnings. This shift reflects the substantial changes in the ILW market since 2022, with improved capacity, reduced losses, and a more favorable capital supply environment driving lower prices.

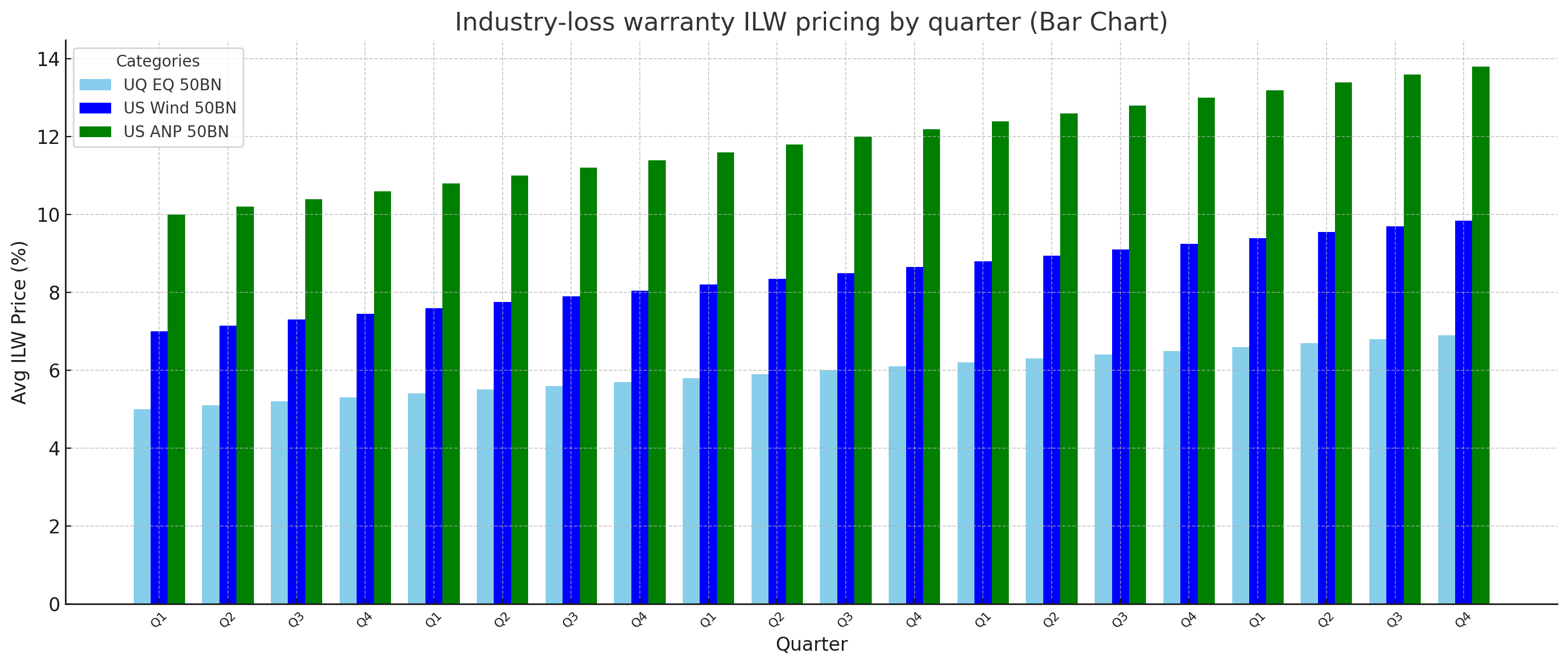

Howden Re noted that U.S. peak peril ILWs starting on January 1, 2025, traded at lower rates-on-line, mirroring price trends across the reinsurance, retrocession, and catastrophe bond markets. For example, nominal rates decreased by 20-30% compared to mid-2024 and by 5-10% relative to January 2024. These reductions have attracted growing interest from a broader range of buyers.

The broker further explained that the ILW market currently offers competitive pricing across various products, including aggregate covers, subsequent event protections, state- and county-weighted ILWs, and multi-year contracts, spanning diverse perils and geographies.

2024 also marked a rise in international ILW trades, particularly for EU wind and flood risks with trigger levels around $10 billion. Additionally, the market is exploring solutions for earnings protection from U.S. severe convective storms, with increasing demand and executed transactions. Parametric solutions are under development, with limits expected to grow quickly following successful trials.

Highlighting the ILW market's flexibility, Howden Re emphasized that insurers, alongside traditional retrocession buyers, are showing increased interest due to improved management of basis risk.

Strong demand and ample supply sustained the ILW market’s momentum into the January 2025 renewals, resulting in high trading levels and signaling further growth prospects for the year ahead.

Howden Re's updated ILW pricing dataset and analysis provide valuable insights into reinsurance and retrocession market dynamics and rates-on-line.

Recent Comment

Thank You

Nice Article Brother

Nice blog